Q1 2025 VC Insights from V17 Advisors

AI Ascendancy

According to the Q1 2025 PitchBook-NVCA Venture Monitor First Look, a staggering 71.1% of the total $91.5B Q1 deal value came from Artificial Intelligence (“AI”) and Machine Learning (“ML”) companies. If this pace continues, 2025 will mark the first year in which the majority of U.S. VC deal value stems from AI and ML, a significant inflection point for the asset class. The quarter culminated with OpenAI’s $40B round, which closed on the final day of March and served as a capstone for an AI-dominated quarter.

Fund Formation Hits Post-Pandemic Low

Q1 2025 saw the successful close of just 87 new VC funds, the lowest quarterly total since the post-pandemic boom of 2022 and only the second time in that period that the number of quarterly reported new funds dipped below 100 (Q1 2023 was the other time with 99 fund closes). These figures stand in stark contrast to the Q2 2022 peak of 216 fund closes. While Q2 2024 offered signs of a rebound with 155 new funds, Q1 2025's sharp decline reintroduces concerns about the strength of the early-stage manager pipeline and broader investor appetite for venture capital.

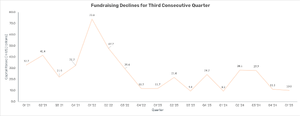

Show Me the Money: Fundraising Continues to Slide

The slowdown in new fund formation is mirrored in the decline in capital raised. In Q1 2022, venture managers raised a record $73.8B. By Q1 2023, that figure had fallen to $11.7B, and in Q1 2025, just $10B was raised, a 9% drop from Q4 2024, marking the third consecutive quarter of decline. While this is not a new post-pandemic low, the continued downward trend in fundraising underscores growing challenges in investor appetite and capital deployment into the venture ecosystem.

AI Deal or No Deal

At first glance, Q1 2025 looked like a breakout quarter for venture deal activity, with $91.5B in total deal value, the highest since Q4 2021 and a 150% increase over Q1 2024. But a closer look reveals a highly concentrated surge. Of the eight deals over $1B, seven were AI companies, underscoring the sector’s continued gravitational pull on venture capital. While the topline metrics suggest a broad rebound, the reality is that AI remains the dominant driver, and other sectors are still struggling to regain momentum. If current trends hold, 2025 may prove to be a narrow bull market led almost exclusively by artificial intelligence.

Conclusion: Cyclical Caution Meets Sectoral Concentration

Over the past nine quarters, new fund formation has fluctuated, showing signs of recovery only to retreat again. Q1 2025 set a new post-pandemic low, but that may prove cyclical rather than structural with room for a Q2 rebound if sentiment stabilizes. More pressing is the continued decline in fundraising, now in its third consecutive quarter, reflecting growing investor conservatism and elongated fundraising cycles.

At the same time, deal value is booming, driven overwhelmingly by AI. While this surge signals investor conviction in next-gen technologies, it also highlights a narrowing venture landscape. With seven of the eight billion-dollar deals in Q1 tied to AI, capital concentration is reaching historic levels.

Key questions for Q2:

- Can the OpenAI halo effect catalyze broader deal activity?

- Will non-AI sectors regain capital share or be left behind?

- Will the number of fund closes increase from Q1’s dire numbers?

For fund managers and allocators, the current environment calls for sharp positioning, operational resilience, and investor-ready infrastructure.

At V17 Advisors, we help emerging and established managers navigate volatile fundraising cycles and build institutional-grade platforms — from compliance and fund operations to investor reporting and due diligence readiness.

Reach out if you are looking to sharpen your edge heading into Q2.